Exploring the World: Travel Insights

Your go-to source for travel tips, destination guides, and cultural insights.

Behind the Mask: Exploring Anonymity in Crypto Platforms

Unmask the truth of anonymity in crypto! Dive into our blog to explore secrets, risks, and the future of private transactions.

The Dual Edges of Anonymity: Security vs. Regulation in Crypto Platforms

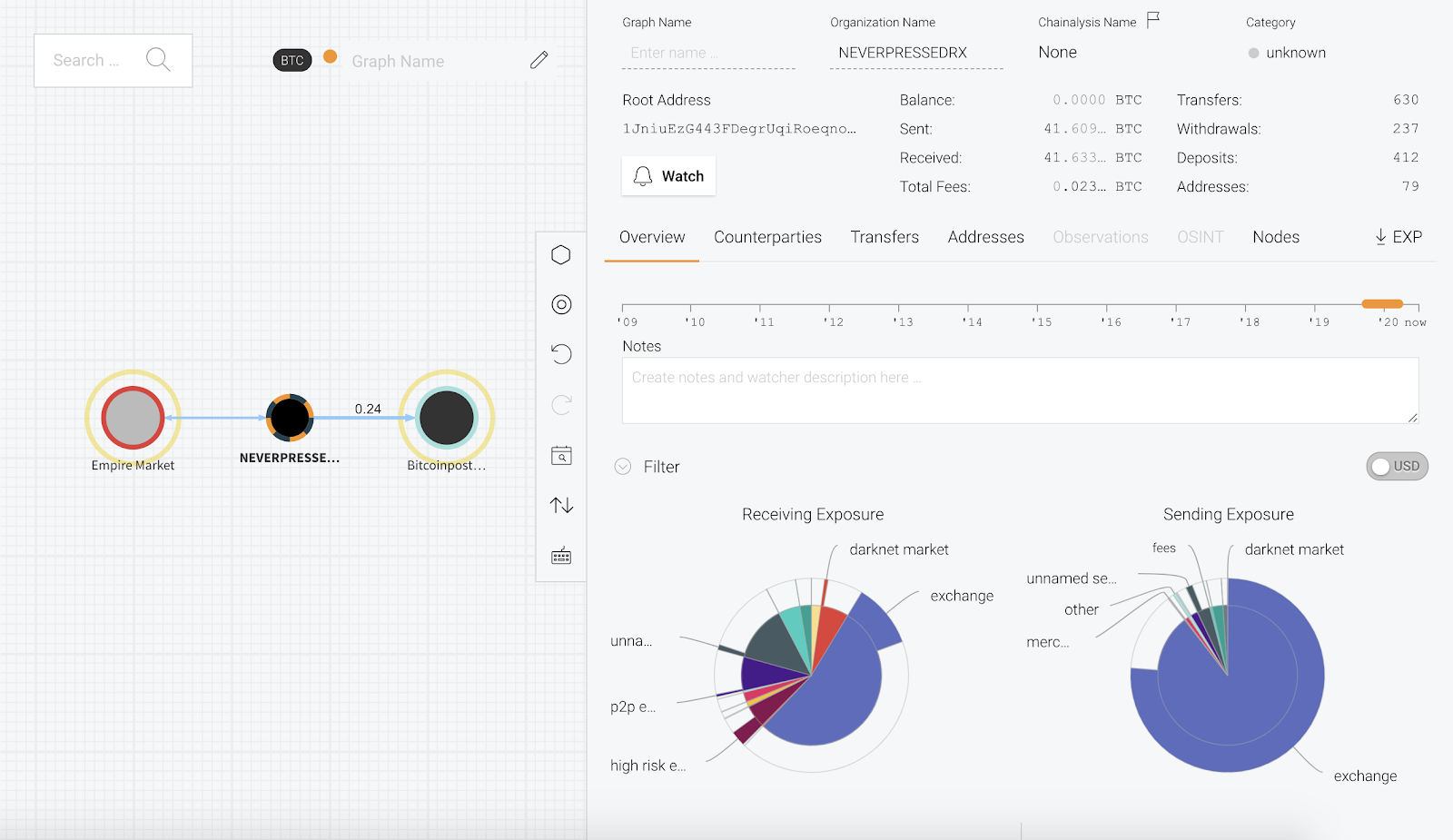

The anonymity afforded by crypto platforms offers users a veil of privacy, protecting their identities and transactions from prying eyes. This security feature is one of the main attractions for many investors who wish to keep their financial activities confidential. Moreover, the decentralized nature of cryptocurrencies means that there’s no single entity capable of tracking or controlling transactions, making it difficult for governments or regulatory bodies to impose restrictions. However, this very advantage can be a double-edged sword, as the same anonymity that protects individuals can also facilitate illicit activities such as money laundering and fraud.

On the other side of the coin lies the growing need for regulation in the cryptocurrency space. As digital currencies gain traction, governments worldwide are grappling with how to regulate these platforms to ensure consumer protection and combat financial crime. While enhancing regulation could diminish the level of anonymity, it may also foster a safer trading environment where legitimate users feel more secure. Striking a balance between security and regulation is crucial; without appropriate oversight, the negative implications of anonymity could undermine the integrity of the entire cryptocurrency ecosystem.

Counter-Strike is a popular first-person shooter game that has become a staple in competitive gaming. Players can engage in intense team-based matches where strategy and skill are paramount. For those looking to enhance their gaming experience, using a cryptocasino.com promo code can provide exciting bonuses and rewards.

Unmasking the User: How Anonymity Shapes Trading Behavior in Cryptocurrencies

The rise of cryptocurrencies has brought about a unique facet of trading behavior, heavily influenced by the anonymity afforded to users. In traditional markets, traders are often subject to regulations that necessitate the disclosure of their identities, creating an environment of accountability. However, in the world of digital currencies, many platforms operate on a decentralized basis, allowing users to trade without revealing their personal information. This anonymity can lead to varied trading patterns, as individuals may feel emboldened to engage in riskier strategies without the fear of reputational damage or regulatory scrutiny.

Moreover, the anonymity in cryptocurrency trading fosters a dual-edged sword of behavior. On one hand, it can empower traders to experiment and innovate, leading to a dynamic market with opportunities for unique trading strategies. On the other hand, this same anonymity can lead to unethical practices such as market manipulation and pump-and-dump schemes, as traders might exploit the lack of accountability. Understanding how anonymity shapes trading behavior is crucial for both traders and regulators as they navigate this rapidly evolving landscape.

Is Anonymity in Crypto Platforms a Blessing or a Curse?

The anonymity offered by crypto platforms is often viewed as a double-edged sword. On one hand, it promotes privacy and protects users from surveillance, empowering individuals to transact without fear of government intervention. This level of anonymity can attract those who prioritize their privacy in the digital age, allowing them to control their financial destinies. As cryptocurrencies evolve, many users appreciate the ability to conduct business and manage assets without revealing personal information, which fosters a sense of security.

On the other hand, this very anonymity can be exploited for illicit activities, making it a curse for society at large. Cases of money laundering, tax evasion, and funding for criminal operations often arise from platforms that prioritize user confidentiality. This raises critical questions about regulatory measures and the need for a balanced approach that protects users while preventing abuse. Ultimately, the debate around anonymity in crypto platforms continues to evolve, highlighting the necessity for both innovation and responsibility in the financial landscape.