Exploring the World: Travel Insights

Your go-to source for travel tips, destination guides, and cultural insights.

Battle-Tested Trading: How to Skin Your Strategy for Success

Unlock winning strategies with Battle-Tested Trading! Discover how to refine your approach and achieve trading success like never before.

Essential Metrics for Evaluating Your Trading Strategy

When assessing the effectiveness of your trading strategy, it is crucial to focus on several essential metrics that can provide insight into your performance. These include return on investment (ROI), which measures the profitability of your trades, and win rate, indicating the percentage of profitable trades relative to your total trades. Additionally, tracking the average gain/loss per trade can help highlight whether your strategy is yielding greater profits than losses over time.

Furthermore, understanding maximum drawdown—the largest peak-to-trough decline in your equity—will give you a sense of risk exposure. You may also want to evaluate your Sharpe ratio, which measures risk-adjusted return, helping you comprehend how well your strategy compensates for the risk you take. By analyzing these metrics, you can make informed adjustments to optimize your trading strategy for better performance in future markets.

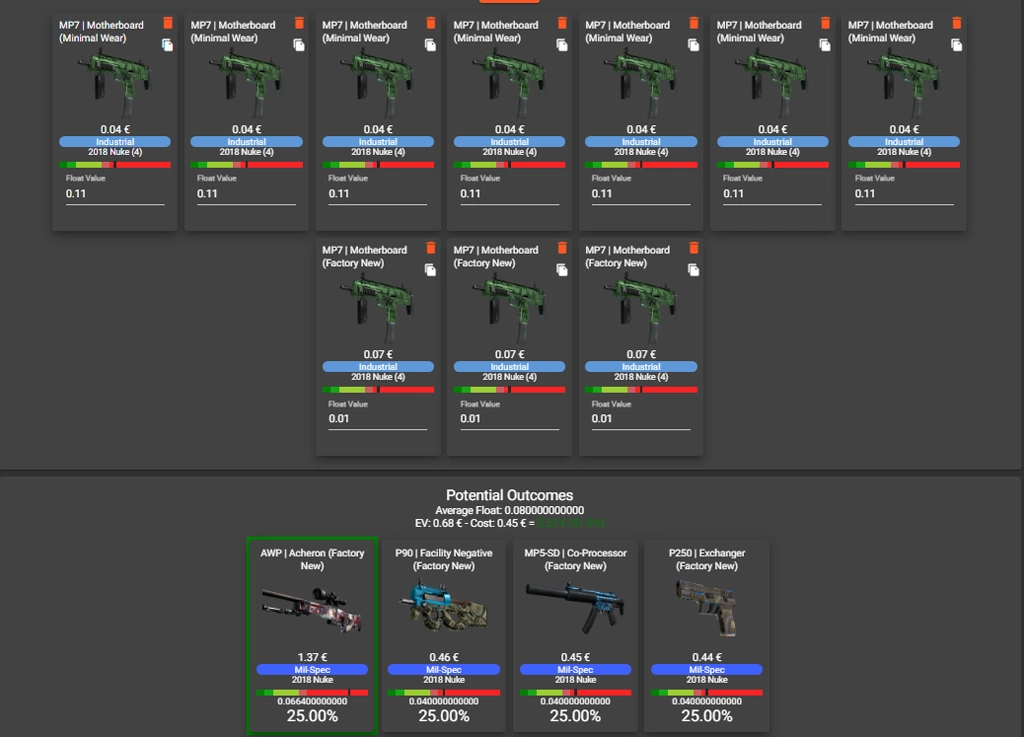

Counter-Strike is a popular first-person shooter game series known for its competitive multiplayer gameplay. Players join either the terrorist or counter-terrorist team, engaging in various objective-based game modes. If you're interested in upgrading your weapons, you can find more information about the path to covert skins that can enhance your gaming experience.

How to Adapt and Evolve Your Trading Tactics in Real-Time

In the fast-paced world of trading, adapting and evolving your trading tactics in real-time is essential for maintaining an edge in the market. Traders must continuously analyze market trends, economic indicators, and technical signals to make informed decisions. To effectively adjust your strategies, consider implementing the following steps:

- Regularly review your performance: Monitor your trading results to identify what works and what doesn't. This analysis can provide valuable insights into your strengths and weaknesses.

- Stay informed: Keep up with financial news, social media trends, and economic reports that can influence market movements. This information can guide your tactical adjustments.

Another crucial aspect of evolving your tactics is embracing technology. Utilize advanced trading platforms and tools that offer real-time data and analytics. For example, automated trading bots can help implement changes based on specific market conditions without requiring constant supervision. Additionally, consider joining trading forums or groups to exchange ideas and learn new strategies from your peers. By adopting a continuous learning mindset and leveraging modern resources, you can enhance your ability to adapt and evolve your trading tactics in real-time.

What Are the Common Pitfalls in Trading Strategies and How to Avoid Them?

When developing trading strategies, traders often encounter common pitfalls that can hinder their success. One major issue is overtrading. This occurs when a trader tries to make too many trades in a short period, driven by the desire to recover losses or capitalize on every market movement. To avoid this, implement a well-defined trading plan that includes specific entry and exit points. Additionally, maintaining a trading journal can help you track your progress and identify patterns in your trading behavior.

Another frequent mistake is neglecting the importance of risk management. Traders often overlook the necessity of setting stop-loss orders or fail to diversify their portfolios adequately. This can lead to significant losses, especially in volatile markets. To mitigate this risk, always assess your risk tolerance and use tools like position sizing to ensure that no single trade can jeopardize your trading capital. Remember, the key to successful trading lies in maintaining a disciplined approach.