Exploring the World: Travel Insights

Your go-to source for travel tips, destination guides, and cultural insights.

Term Life Insurance: Your Safety Net or a Fading Shadow?

Explore the truth behind term life insurance—will it be your safety net or just a fading shadow? Uncover the reality now!

5 Key Benefits of Term Life Insurance You Need to Know

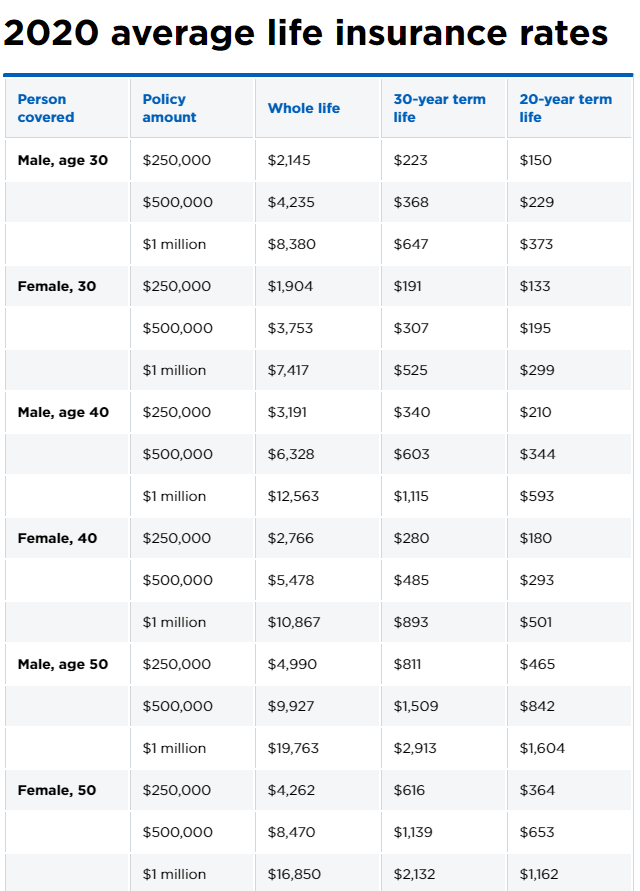

Term life insurance is a vital financial tool that provides a safety net for your loved ones in case of unforeseen circumstances. One of the most significant benefits of term life insurance is its affordability. Compared to permanent life insurance, term policies typically have lower premiums, allowing you to obtain a substantial death benefit at a fraction of the cost. This means you can provide financial security for your family without breaking the bank.

Another key advantage is the simplicity of term life insurance. Policies are straightforward, making it easier for consumers to understand their coverage. Term life insurance offers flexibility as well; you can choose coverage periods that align with your financial responsibilities, such as your children's education or your mortgage payoff. With clear terms and options, term life insurance ensures that you can meet your family's needs during critical phases of life.

Is Term Life Insurance Right for You? Debunking Common Myths

When considering term life insurance, many people are influenced by misconceptions that can cloud their judgment. One common myth is that term life insurance is too expensive; however, the truth is that term policies often offer coverage at a fraction of the cost compared to whole life insurance. In fact, an average healthy individual may secure a substantial coverage amount for just a few dollars a month. Therefore, it's important to assess your financial situation and compare quotes to find an option that best meets your needs.

Another prevalent myth is that term life insurance offers no cash value, leading people to believe it holds no long-term benefit. While it’s true that term life insurance does not accumulate cash value like whole life policies, it provides the essential benefit of financial protection for your loved ones during a specific period. Many individuals find that this targeted coverage aligns well with their financial goals, making it a practical choice for those needing temporary security, such as raising children or paying off a mortgage.

What Happens When Your Term Life Insurance Expires?

When your term life insurance policy expires, it can lead to various outcomes depending on the specific terms of your policy. Typically, term life insurance policies are designed to provide coverage for a set period, often ranging from 10 to 30 years. Once this period ends, your coverage concludes unless you choose to renew the policy or convert it to a permanent life insurance policy. If you do not take action, your beneficiaries will not receive any death benefits, and you may be left without financial protection.

It's important to understand your options when your term life insurance expires. You may have the opportunity to renew your policy at a higher premium or convert it to a permanent policy without a medical exam, depending on the insurer's guidelines. If you opt not to renew or convert, it’s crucial to reassess your life insurance needs and consider other forms of coverage to ensure that your loved ones are financially secure in the event of your passing.