Exploring the World: Travel Insights

Your go-to source for travel tips, destination guides, and cultural insights.

Forex Frenzy: Why Chasing the Big Win Could Burn Your Wallet

Discover why chasing massive forex wins can drain your wallet faster than you think! Uncover the truth behind the hype.

The Dangers of High-Risk Trading: Understanding the Forex Gamble

High-risk trading, particularly in the Forex market, can lead to devastating financial losses if not approached with caution. Traders often underestimate the volatility of currency pairs and the rapid fluctuations that can occur within short time frames. This unpredictability creates a high-risk environment where inexperienced traders may feel an oversimplified understanding of market dynamics could yield significant profits. In reality, many beginner traders find themselves on a precarious path, often losing their initial investments and more due to emotional decision-making and lack of adequate risk management strategies.

Moreover, high-risk trading can lead to a dangerous cycle of desperation, where traders compound their losses by increasing their exposure in hopes of recovering previous losses. According to research, over 70% of retail forex traders lose money, a stark reminder of the inherent dangers involved. These statistics highlight the importance of education and sound trading strategies. For anyone interested in delving deeper into the mechanics of Forex trading, understanding risk management and developing a solid trading plan is vital to enhancing long-term success while mitigating potential pitfalls.

Chasing the Big Win: How to Avoid Common Forex Pitfalls

The foreign exchange market, or Forex, can be a lucrative arena for traders, but pursuing that big win often leads to common pitfalls. One major mistake many traders make is succumbing to the lure of over-leveraging their investments. Leverage can amplify gains, but it can also exacerbate losses, leading to rapid account depletion. To mitigate this risk, it is essential to establish a risk management strategy that includes setting stop-loss orders and diversifying investments. By staying disciplined and avoiding the temptation to chase quick profits, traders can better position themselves for long-term success.

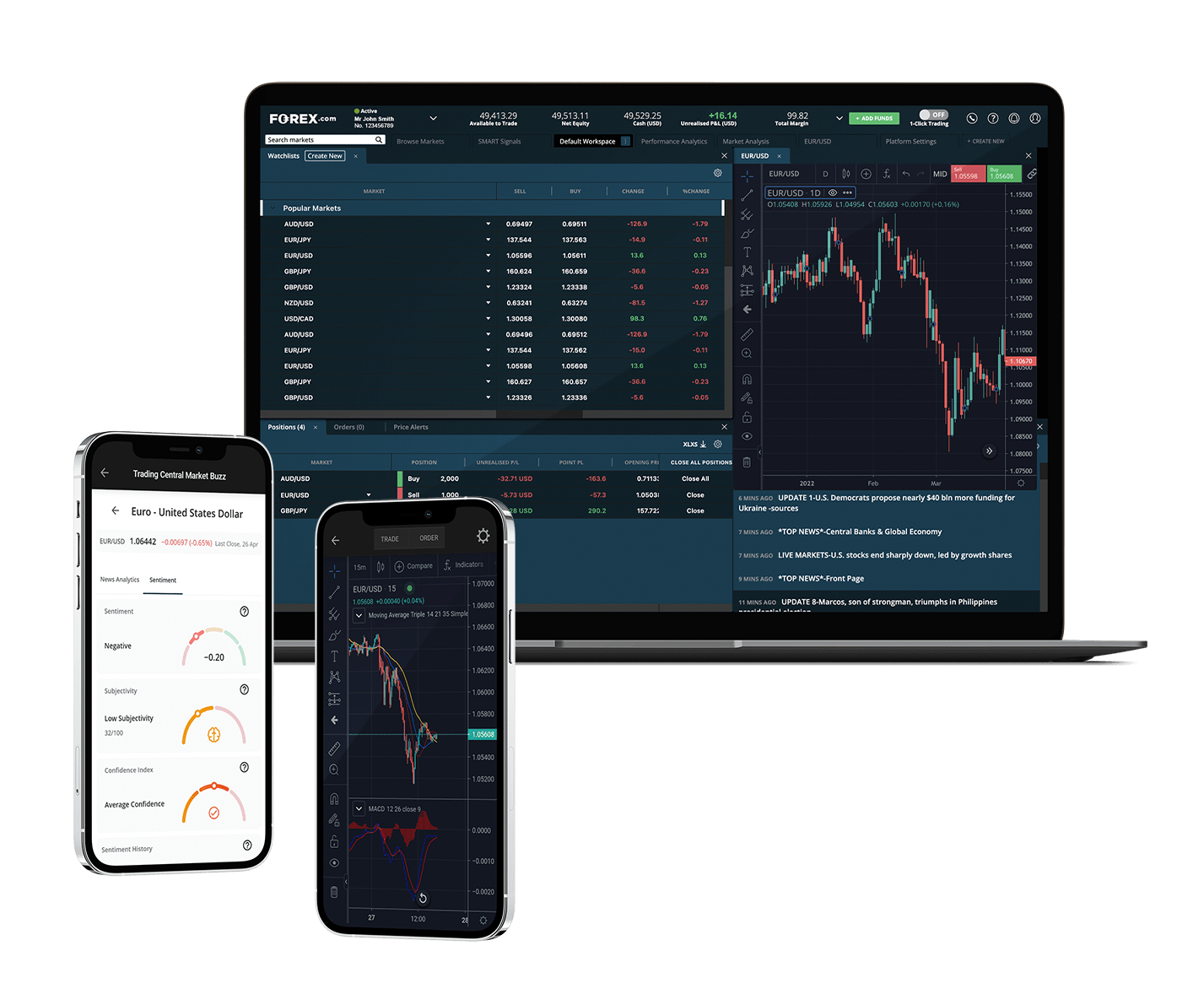

Another common pitfall is allowing emotions to drive trading decisions. Trading can be stressful, and emotions like fear and greed often cloud judgment. Traders should aim to maintain a level-headed approach, relying on data-driven analysis rather than impulsive reactions. Additionally, it's crucial to educate oneself continually about the market trends and strategies. Resources such as Forex.com offer valuable insights and tools to help traders enhance their knowledge and skills. By adopting a disciplined, informed approach, aspiring forex traders can dodge these pitfalls and increase their chances of achieving that elusive big win.

Is the Forex Market Worth the Risk? Exploring the Myths and Realities

The Forex market, or foreign exchange market, is one of the most liquid and largest financial markets in the world, often boasting daily trading volumes exceeding $6 trillion. With such vast opportunities, many traders are lured by the prospects of high returns. However, the market's complexity brings various risks that require careful consideration. Some common myths include the belief that Forex trading is a guaranteed path to quick wealth. In reality, success in this market demands extensive knowledge, strong analytical skills, and a disciplined approach to risk management. For more insights on this topic, you can read from Investopedia.

Understanding the realities of Forex trading is critical for anyone contemplating this venture. While the potential for profit is significant, it is equally important to acknowledge that losses are part of the trading experience. Many novice traders often enter the market underestimating its volatility and the emotional strain it can induce. According to experts, having a well-structured trading plan and continuously educating oneself about market trends and strategies is vital. As Forex.com highlights, the path to successful Forex trading involves understanding both the market's mechanics and one's own psychological responses to risk.