Exploring the World: Travel Insights

Your go-to source for travel tips, destination guides, and cultural insights.

Why Settle for Average? Discover the Insurance Deal of Your Dreams

Unleash your potential! Find the insurance deal you've always dreamed of and stop settling for average. Your perfect policy awaits!

Unlocking Exceptional Value: How to Find Your Ideal Insurance Plan

Finding the ideal insurance plan can seem overwhelming, but by following a few simple steps, you can unlock exceptional value for your needs. Start by assessing your requirements: consider factors such as your health, lifestyle, and financial situation. Researching various types of insurance—including health, auto, homeowners, and life insurance—will allow you to compare options effectively. Make a list of your priorities, and utilize online tools and resources to gain insights into different policies available in your area.

Once you've narrowed down your options, dive deeper into each plan's specifics. Look for hidden costs, coverage limits, and customer reviews to gauge the plan's true value. Don't hesitate to reach out to insurance agents for personalized advice or to request quotes. Remember, the cheapest plan isn't always the best. Focus on finding a balance between affordability and comprehensive coverage to ensure you get the best insurance plan that meets your unique needs.

The Ultimate Guide to Choosing the Right Insurance: Don’t Settle for Less!

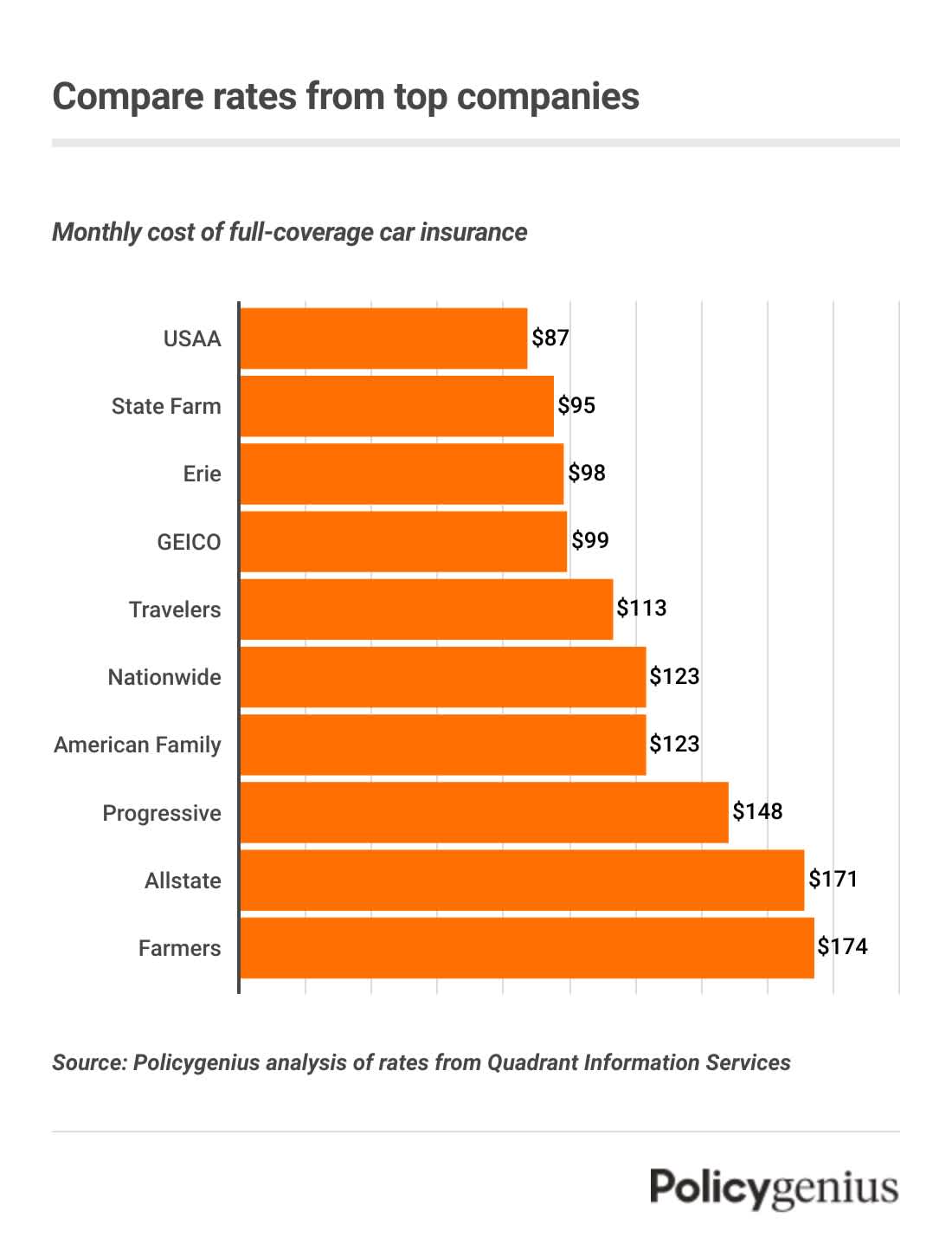

Choosing the right insurance can be a daunting task, especially with the myriad of options available in the market today. To ensure you make an informed decision, start by assessing your specific needs and comparing various policies. Don’t settle for less! Begin with gathering quotes from multiple providers, which can give you a clearer picture of what to expect in terms of coverage and pricing. Consider using a checklist that includes factors such as coverage limits, deductibles, and customer reviews to guide your evaluation process.

Once you have a list of potential insurance providers, take the time to read the fine print in each policy. Pay special attention to exclusions and any additional fees that may apply. One key aspect to remember is that the cheapest option is not always the best. Prioritize companies with strong customer service ratings and a history of reliable claims handling. Remember, the ultimate goal is to find comprehensive coverage that protects your interests without breaking the bank.

What to Look for in a Dream Insurance Deal: Key Factors to Consider

When searching for your dream insurance deal, it's essential to consider various key factors that can significantly impact your experience and financial security. First, evaluate the coverage options available to you. Comprehensive coverage typically provides a broader range of protection, while basic plans may be more budget-friendly. Always assess what types of incidents are covered, and whether you need additional riders for specific situations. A clear understanding of the terms and the extent of coverage can prevent any unpleasant surprises down the line.

Another important factor to consider is the deductible. A higher deductible might lower your premium, but it also means you'll pay more out-of-pocket in the event of a claim. Conversely, a lower deductible can provide peace of mind in emergencies but may increase your monthly payments. Additionally, research the insurance provider’s reputation by reading customer reviews and examining their claims process. A company with favorable ratings and a transparent claims process can make all the difference when you need to utilize your policy.