Exploring the World: Travel Insights

Your go-to source for travel tips, destination guides, and cultural insights.

Bargain Hunting for Your Ride: Snagging Hidden Auto Insurance Discounts

Uncover hidden auto insurance discounts and save big! Discover expert tips for bargain hunting your ride's coverage today!

Top 10 Hidden Auto Insurance Discounts You Might Be Overlooking

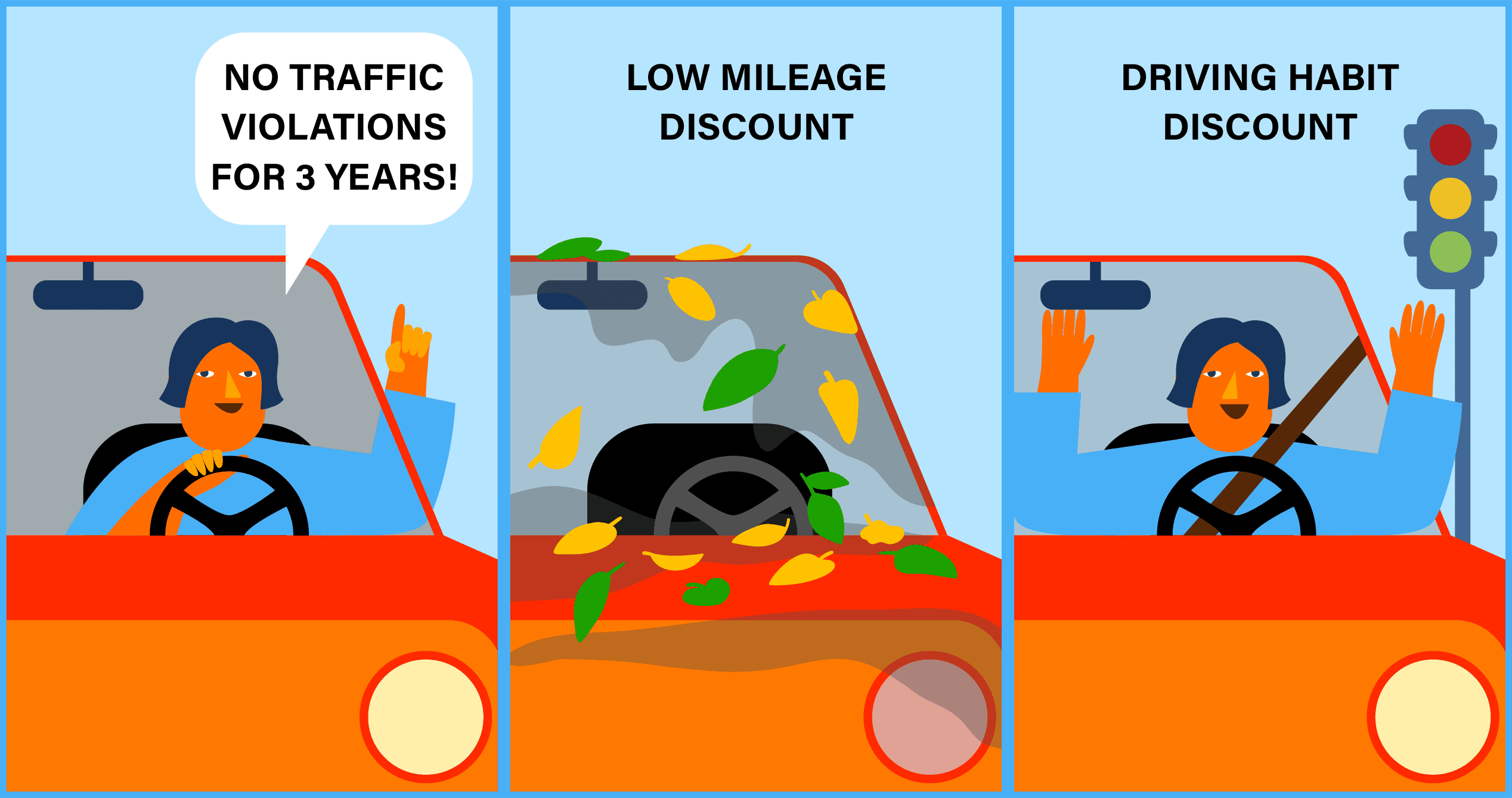

When it comes to saving money on your car insurance, many drivers might be unaware of several hidden auto insurance discounts that are readily available. These discounts can significantly reduce your premium if you qualify for them. For example, some insurers offer discounts for successfully completing a defensive driving course, while others may reward you for being a good student. Similarly, bundling multiple types of insurance, such as home and auto, often leads to lower rates. It's essential to discuss your eligibility for these programs with your insurance provider.

Another way to uncover hidden savings is by evaluating your vehicle's safety features. Many insurance companies provide discounts for cars equipped with advanced safety technologies like anti-lock brakes, airbags, and collision-avoidance systems. Additionally, don’t forget to ask about loyalty discounts if you've been with your provider for several years. Here are the top 10 hidden auto insurance discounts you might be overlooking:

- Defensive driving course completion

- Good student discount

- Bundling insurance policies

- Vehicle safety features

- Loyalty discounts

- Low mileage discount

- New car discount

- Military or Union member discounts

- Pay-in-full discounts

- Occupation-related discounts

How to Optimize Your Auto Insurance Premium: Tips for Bargain Hunters

When it comes to optimizing your auto insurance premium, the first step is to regularly review your coverage. Start by evaluating your current policy and identifying areas where you can reduce expenses without sacrificing essential protection. For example, consider adjusting your deductible; increasing it could lower your premium significantly. Also, be proactive in exploring discounts that insurers may offer, such as multi-policy discounts or safe driver incentives. Furthermore, maintaining a good credit score can lead to better rates, so it's wise to keep an eye on that as well.

Another effective strategy for bargain hunters looking to optimize their auto insurance premium is shopping around for quotes. Utilize online comparison tools to get a sense of what different providers offer and identify the best deals available. Don't hesitate to negotiate with your current insurer by presenting lower quotes from competitors; they may be willing to match or even beat those prices. Lastly, consider taking a defensive driving course, as many insurance companies offer discounts for drivers who complete such programs, reinforcing the notion that safe driving can translate to significant savings on your auto insurance.

Are You Missing These Secrets to Lower Your Car Insurance Costs?

Car insurance can often feel like a financial burden, but there are hidden strategies that can help you reduce your premiums significantly. One essential secret is shopping around for quotes. Many drivers make the mistake of sticking with their current insurance provider, but prices can vary widely across companies. By taking the time to compare rates from multiple insurers, you might discover substantial savings. Additionally, consider asking about available discounts—many companies offer reductions for safe driving records, bundling policies, or even for being a loyal customer.

Another effective way to lower your car insurance costs is by adjusting your deductible. Increasing your deductible is a simple step that can lead to lower monthly premiums. However, make sure you choose a deductible that you can comfortably afford in the event of a claim. Furthermore, maintaining a good credit score can also play a crucial role; insurers often offer better rates to those with higher credit scores. In conclusion, by implementing these strategies, you can unlock significant savings on your car insurance costs that you may have otherwise overlooked.